Emerging Technologies

The Impact of AI in Insurance: Transforming Claims, Underwriting, Risk Management, and More

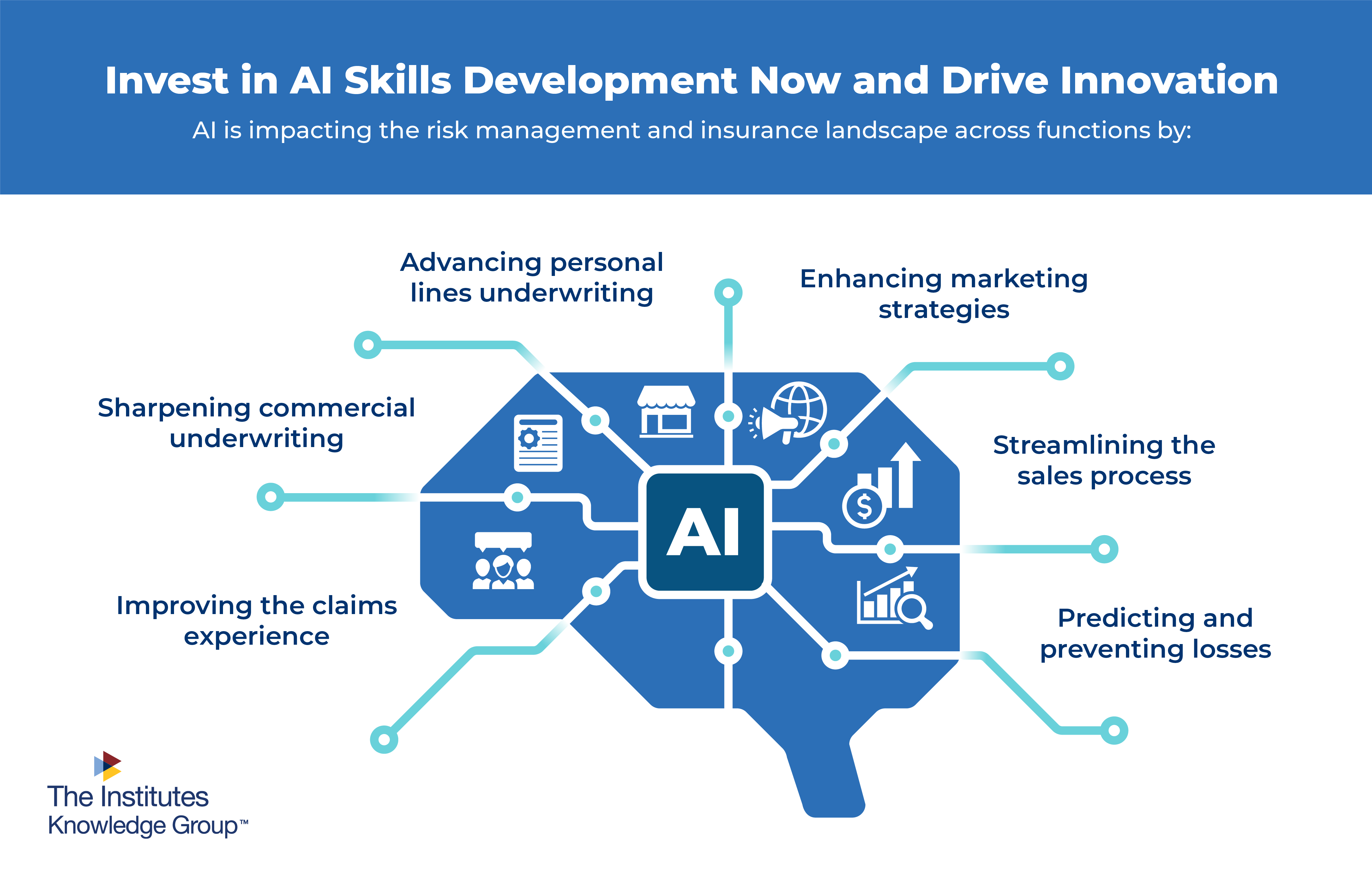

The entire risk management and insurance landscape is in the middle of a significant culture shift as artificial intelligence (AI) reshapes traditional workflows and decision-making processes. Not only is it changing business operations and efficiencies, but it’s also transforming the way professionals need to think. In fact, 77% percent of executives believe that generative AI will have a bigger impact on broader society in the next 3 to 5 years than any other emerging technology.

The adoption of AI integration into claims, underwriting, marketing, sales, and risk management is not a distant future—it’s happening today. The organizations that embrace AI in insurance functions and equip their teams with the right skills will gain a competitive edge through enhanced efficiency and predictive accuracy.

Read on to explore how AI is already impacting risk management and insurance functions, and how your organization can leverage its benefits!

Improving the Claims Experience

There’s no arguing that AI has enabled faster and more accurate claims processing and resolutions. Virtual assistants like chatbots are improving claims transparency and handling customer inquiries faster, creating a more efficient claims experience. Behind the scenes, AI is also automating daily tasks such as fraud detection, document review, and claims triage that might otherwise go unnoticed. All of this is leading to increased customer service expectations, which can’t be met without continuous investments in these technologies.

However, the human element of claims management remains more essential than ever. While claims professionals can now invest less time in repetitive tasks, they instead need to know how to interpret AI outputs correctly to make informed decisions. This shift allows them to focus more time on complex claims that require human judgment and provide a personal touch customers still expect.

Advancing Commercial and Personal Lines Underwriting

New AI-based tools, like telematics devices in vehicles and smart sensors in buildings, are analyzing IoT data to provide unprecedented granular insights that are reshaping the entire underwriting function. As a result, underwriters are transitioning from task-based work to strategic risk advisory functions. Explore what this looks like for commercial vs. personal lines underwriting processes:

Commercial Underwriting: AI and machine learning streamlines data collection, providing real-time risk insights and predictive models that change how underwriters approach their work. The most successful commercial underwriters are transitioning from manual evaluations to managing AI-driven risk analytics.

Personal Lines Underwriting: AI enables more personalized pricing, policy recommendations, and customer segmentation. Personal lines underwriters must learn to translate AI recommendations into clear explanations for customers as their focus shifts from routine assessments to exception handling and relationship management.

Enhancing Marketing Strategies

By leveraging the power of AI technology, marketers are more empowered than ever to take the guesswork out of their promotional strategies. Not only do predictive customer behavior models allow marketing teams to better anticipate customer needs and preferences, but other AI technology also enables hyper-focused segmentation and real-time campaign adjustments. All of this helps organizations send the right message to the right customers at the right time.

At the same time, marketers need to balance creativity with data literacy. This includes collaborating effectively with data scientists to interpret AI insights, applying analytics to creative strategy development, and understanding how to leverage AI tools for campaign optimization. By blending the art of marketing with the science of AI and data literacy, RMI professionals can speak the language of data to deliver better, measurable results.

Streamlining the Sales Process

AI tools are empowering sales teams to work smarter by prioritizing leads and helping them focus on high-value prospects. For example, generative AI is a great asset for crafting personalized proposals tailored to each client’s needs. Automated renewals reduce administrative burdens and improve retention rates. And AI-driven insights align insurance products with customer behavior and preferences.

The most successful sales professionals now combine relationship-building skills with AI literacy to better understand customer profiles and anticipate their needs. This powerful combination helps them create more meaningful and productive client relationships, while also improving the reputation of your organization.

Predicting and Preventing Losses

The advancements AI has made in claims, underwriting, sales, and marketing are incredible, but the most transformative impact AI has had might be in risk assessments and management. This rapidly evolving technology is able to leverage real-time and historical data to predict risks. Wearable and IoT devices provide continuous data streams that allow for immediate risk detection and in real-time mitigation, while other AI-powered tools can predict weather-related losses and enable insurers to advise clients on preemptive measures.

AI technology has only accelerated the profound shift toward the Predict & Prevent® approach, which is focused on predicting and preventing losses before they occur, rather than responding after a loss. Now, risk management roles are evolving to focus on interpreting AI predictions and creating actionable strategies from those insights. For real-world examples of these transformations, tune into the Predict & Prevent® podcast, where RMI leaders share their experiences implementing AI-driven risk management.

Driving Innovation and Embracing AI in Insurance

AI isn't a future technology—it’s already transforming the RMI landscape today. And the most successful risk management and insurance companies are those embracing AI solutions in their day-to-day work and using it to enhance their capabilities.

By empowering your team to invest in AI skills development now, you can position your organization to be at the forefront of innovation. That's why The Institutes Knowledge Group offers standalone, introductory AI online courses that are designed specifically for various roles in risk management and insurance. In as little as one hour, your employees can build a solid foundation in AI literacy and learn how to leverage AI in their day-to-day work.

Take the next step in preparing your team for success in an AI-enhanced landscape today!

About the Author

Adam Carmichael, CPCU, is President of The Institutes Knowledge Group. He leads the strategic development and delivery of courses and exams for risk management and insurance designation programs. He also oversees new course creation to ensure The Institutes’ education aligns with professional development needs. With more than 25 years in research and assessments, he brings deep expertise in professional development.