Risk Management Strategies

The Rising Cost of Catastrophe Risks: What Every RMI Professional Should Know

Every September, National Preparedness Month serves as a reminder that readiness is essential in today’s risk landscape. For risk management and insurance (RMI) professionals, this year’s observance is especially timely. The physical and financial toll of catastrophes continues to rise due to events like hurricanes, wildfires, and geopolitical unrest.

In response to this rapidly growing and evolving threat, The Institutes Designations recently launched the new Associate in Catastrophe Risk and Resiliency™ (ACRR™). This program was developed to help professionals gain in-demand skills to identify exposures, implement holistic mitigation strategies, and strengthen the resiliency of organizations and communities.

Test Your Knowledge of Catastrophe Risk

What is catastrophe risk?

Catastrophe risk refers to the potential for large-scale losses caused by natural events like hurricanes, floods, and wildfires or by human-caused disasters such as cyberattacks or political unrest. According to the Insurance Information Institute, an event is considered a catastrophe when insured losses exceed $25 million and affect many policyholders.

What is the catastrophe risk model?

A catastrophe risk model is a tool insurers and risk managers use to estimate potential losses from catastrophic events. These models combine historical data, scientific research, and exposure information to help organizations plan for worst-case scenarios.

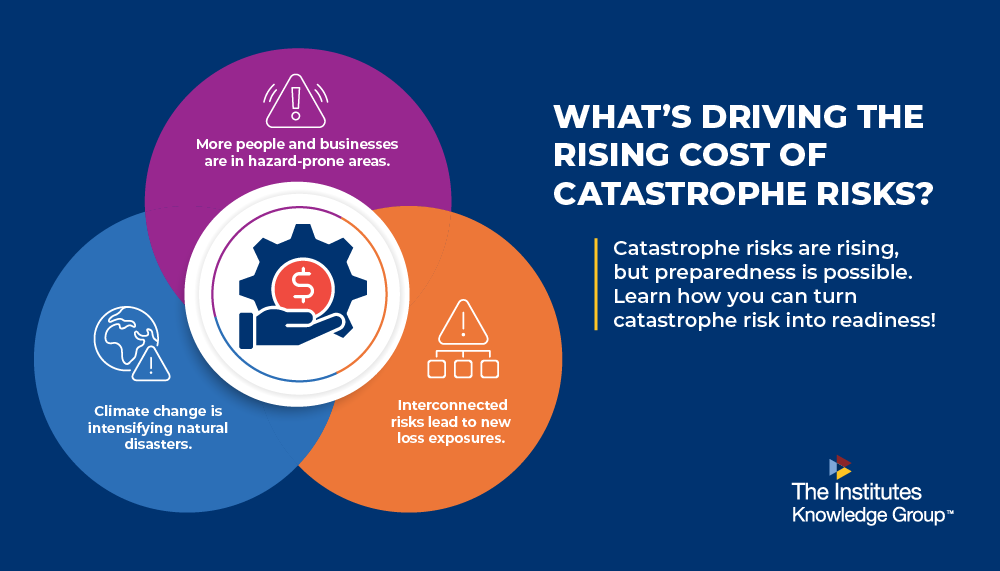

What’s Driving the Rising Cost of Catastrophe Risks?

The cost of catastrophe risk is surging for several reasons:

- Climate change is intensifying natural disasters. Stronger hurricanes, more destructive wildfires, more frequent floods, and longer droughts are reshaping loss patterns.

- Societal changes are amplifying exposures. More people and businesses are located in coastal regions, wildfire zones, and other hazard-prone areas.

- Human-caused threats are expanding. Beyond natural disasters, risks such as cyberattacks, industrial accidents, and geopolitical conflict now carry catastrophic implications.

And Just How High Are the Costs of Catastrophe Risks?

According to the Insurance Information Institute, there are various key stats on catastrophic risks that make the urgency clear:

- Global insured natural‑catastrophe losses were $145 billion in 2024, which was the sixth‑costliest year on record.

- Natural catastrophes generated approximately $112.8 billion in insured losses in 2024.

- The potential total loss from cybercrime increased to $16.6 billion in 2024, up from $12.5 billion in 2023.

In summary, these numbers reflect more than insurance payouts. They represent lost homes, disrupted communities, and long-term business interruptions that strain organizations far beyond the initial disaster.

Why Traditional Risk Management Strategies Aren't Enough

Insurance alone cannot absorb the impacts of today’s catastrophe risks. Coverage gaps and rising deductibles make it harder for organizations to rely solely on traditional transfer strategies.

At the same time, interdependencies are straining existing approaches to catastrophe risk management:

- Supply chain disruption after wildfires or floods can shutter factories worldwide.

- Community displacement after hurricanes or earthquakes affects workforce stability.

- Political unrest may lead to the closure of shipping channels, leaving companies unable to access raw materials.

Ultimately, catastrophe risks are no longer isolated events; they create a complex web of challenges that can ripple across industries and communities.

What RMI Professionals Can Do Now

Data and catastrophe risk models help RMI professionals, but they cannot completely eliminate the uncertainty these risks bring. Simply put: Preparedness now requires holistic, forward-looking strategies that extend beyond financial protection. Steps that strengthen catastrophe risk management include:

- Adopting proactive risk assessment methods such as scenario planning and stress testing.

- Developing mitigation strategies such as investing in resilient infrastructure, diversifying supply chains, and crafting disaster recovery plans.

- Strengthening collaboration across claims, underwriting, operations, and external partners like government agencies and community organizations.

- Focusing on ethics and communication, ensuring risk strategies balance financial outcomes with community well-being.

- Committing to continuous learning, staying current with evolving catastrophe risk modeling, emerging perils, and best practices.

Turn Catastrophe Risk into Readiness with ACRR

RMI professionals must adapt their skill sets as catastrophe risks continue to evolve. The Institutes Designations’ new Associate in Catastrophe Risk and Resiliency™ (ACRR™) provides a framework for managing both natural and human-caused catastrophe risks that will remain relevant even as threats change over time.

ACRR equips RMI professionals to:

- Mitigate natural catastrophe risks such as floods, wildfires, and earthquakes.

- Better manage human-caused risks like geopolitical disruption and industrial accidents.

- Anticipate outcomes by examining the interconnected nature of catastrophe risks.

- Spot warning signs before catastrophes negatively affect business operations.

Learn more about ACRR and how it can help you strengthen resiliency for organizations and communities. You can also try the free ACRR sample course to preview the content and determine if the program fits your professional goals.