General RMI Trends & Insights

The Retirement Wave: Filling Your Leadership Pipeline to Shape the Future of Insurance

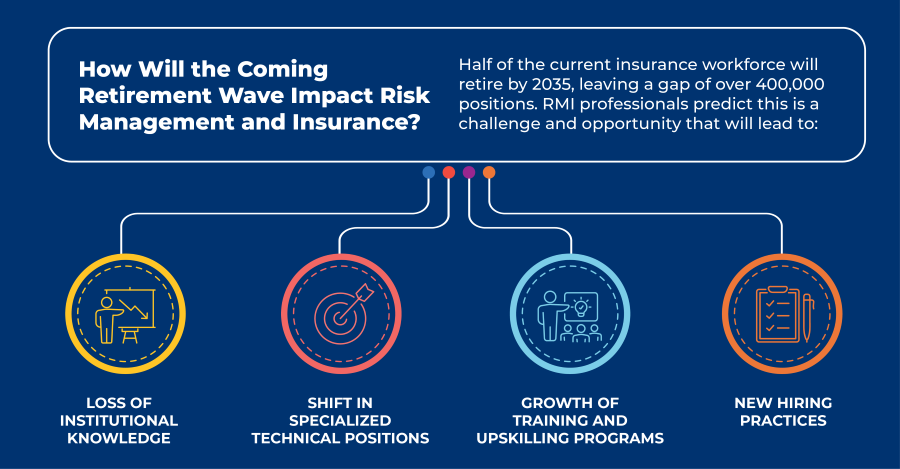

The coming retirement wave is the single largest talent disruptor facing risk management and insurance (RMI) today. Half of the current insurance workforce will retire by 2035, leaving a gap of over 400,000 positions, according to a report from the U.S. Bureau of Labor Statistics. The RMI landscape has often adapted well to change, yet the next nine years represent both a challenge and a defining opportunity.

As we kick off 2026, learning and development (L&D) and talent management leaders can bring renewed momentum in facing the growing talent shortage. This is a chance to invest in your people, strengthen your leadership pipeline, and shape what the future of insurance and risk management will look like.

Explore how professionals in the Property & Casualty market believe the looming retirement wave could affect critical knowledge and leadership readiness, as well as present opportunities for growth and renewal across the RMI space.

Loss of Institutional Knowledge and Leadership Pipelines

What impact will the retirement wave have on the insurance landscape? The numbers tell a compelling story: 73% of RMI professionals believe the loss of institutional knowledge will be the most significant impact of the retirement wave, according to a survey conducted by The Institutes Enterprise Research team. This knowledge gap isn't limited to technical expertise: It extends to leadership skills, strategic decision-making, and mentorship. Left unaddressed, this loss of experience can quietly weaken your organization’s leadership pipeline. However, with the right professional development strategy, it can also open the door to developing and defining the next generation of leaders.

As seasoned professionals leave, insurers need to ensure key insights and processes don’t leave with them. One effective approach is building a structured knowledge-transfer system that includes:

- Clear documentation and playbooks that capture critical expertise

- Formal mentorship programs that connect seasoned leaders with emerging talent

- Succession planning that looks ahead to the future (not just today’s roles)

By developing your leadership pipeline now, you create stability while preparing for what’s next.

Impact on Specialized Positions

Following that, technical roles that form the backbone of insurance operations are also at risk. 60% of surveyed RMI professionals expect shortages in underwriting, claims, and other technical skills. Additionally, 43% anticipate these roles will decline in the coming years. But why?

Many organizations expect to fill technical role gaps through AI and automation. As a result, those who learn how AI and machine learning is transforming insurer operations and can pair that knowledge with AI expertise will be in high demand. Still, the strongest organizations will focus on developing technically skilled talent who are also ready to step into leadership roles. This balanced approach supports both operational excellence and long-term leadership growth.

However, within this disruption lies opportunity. Organizations that invest in professional development now can emerge with a workforce that is more confident, more skilled, and more resilient than ever.

Growth of Training and Upskilling Programs

For L&D leaders who have been looking for a reason to expand their professional and leadership development programs, now is the time. Continuous learning is one of the most effective ways to address the talent shortage, as it allows professionals at all levels to grow their expertise and remain resilient. But it only works when programs are intentional, well-structured, and aligned with business goals. Consider supporting employees through clear career pathways that equip them with in-demand technical and leadership skills. This is where trusted, RMI-specific education becomes invaluable.

For example, The Institutes Knowledge Group offers a wide range of online courses and Institutes Designations designed to help build foundational, technical, and leadership skills to stay ahead of evolving RMI trends. Each program is backed by The Institutes’ more than 115 years of experience as a not-for-profit, committed to educating, elevating, and connecting those interested in risk management and insurance to create a more informed, resilient world.

Updated Hiring Practices

As you strengthen internal talent development, your hiring practices should also evolve. 58% survey respondents expect entry-level positions to be filled from outside the current RMI job market. This shift will require organizations to move beyond traditional competency-and-experience-based recruiting models toward skills-based hiring approaches.

Not only will this expand the pool of potential candidates, it will also likely bring fresh perspectives into your organization. Those who haven’t worked in risk management and insurance before but have transferable soft skills—like customer service and critical thinking—will be able to grow their knowledge in entry-level positions and can bring innovative thinking to current business models. The key is creating onboarding and mentorship programs that effectively integrate these new hires.

How Can I Shape the Future of Insurance Today?

Don’t forget: The retirement wave is already underway. But with the right strategy, it can unlock a new era of risk management and insurance that builds on the work previous generations have already started. Early- and mid-career professionals will find new opportunities to advance, while organizations can intentionally address the skills gap and invest in future leaders.

Want to dive deeper into the data behind these trends? Take a look at our benchmarking whitepaper for insights that can guide your strategic planning.

About the Author

Eric Czerwin is Director of Sales for The Institutes Knowledge Group. With a background in risk management and underwriting, he bridges strategic insight with practical execution while fostering long-term relationships. His focus is on empowering carrier workforces with enhanced skills and insurance field knowledge through organizational learning and development initiatives.