Imagine making informed decisions, predicting risks accurately, and tackling strategic business challenges—all through the incredible power of data. The evolution of data science in insurance is redefining business practices, making it essential for RMI professionals to continuously upskill to stay competitive.

Keep in mind, data science doesn’t have to be intimidating! With a basic understanding, you can learn to speak the language of data, collaborate confidently across your organization, and fully leverage data-driven insights.

Why Every RMI Professional Needs A Data-First Mindset

Data science processes vast amounts of data to extract valuable insights that can be leveraged across the business.

Because the fields of risk management and insurance rely on data for informed decision-making, professionals across the business value chain must have a solid understanding of data science principles. They also need a mindset to prioritize data and analytics throughout day-to-day operations. Whether your role is in risk management, claims, underwriting, marketing, or any other function, it’s important that you’re comfortable working with data.

Embracing this mindset not only helps you stay resilient and competitive in a rapidly changing environment, but also empowers you to speak the language of data effectively.

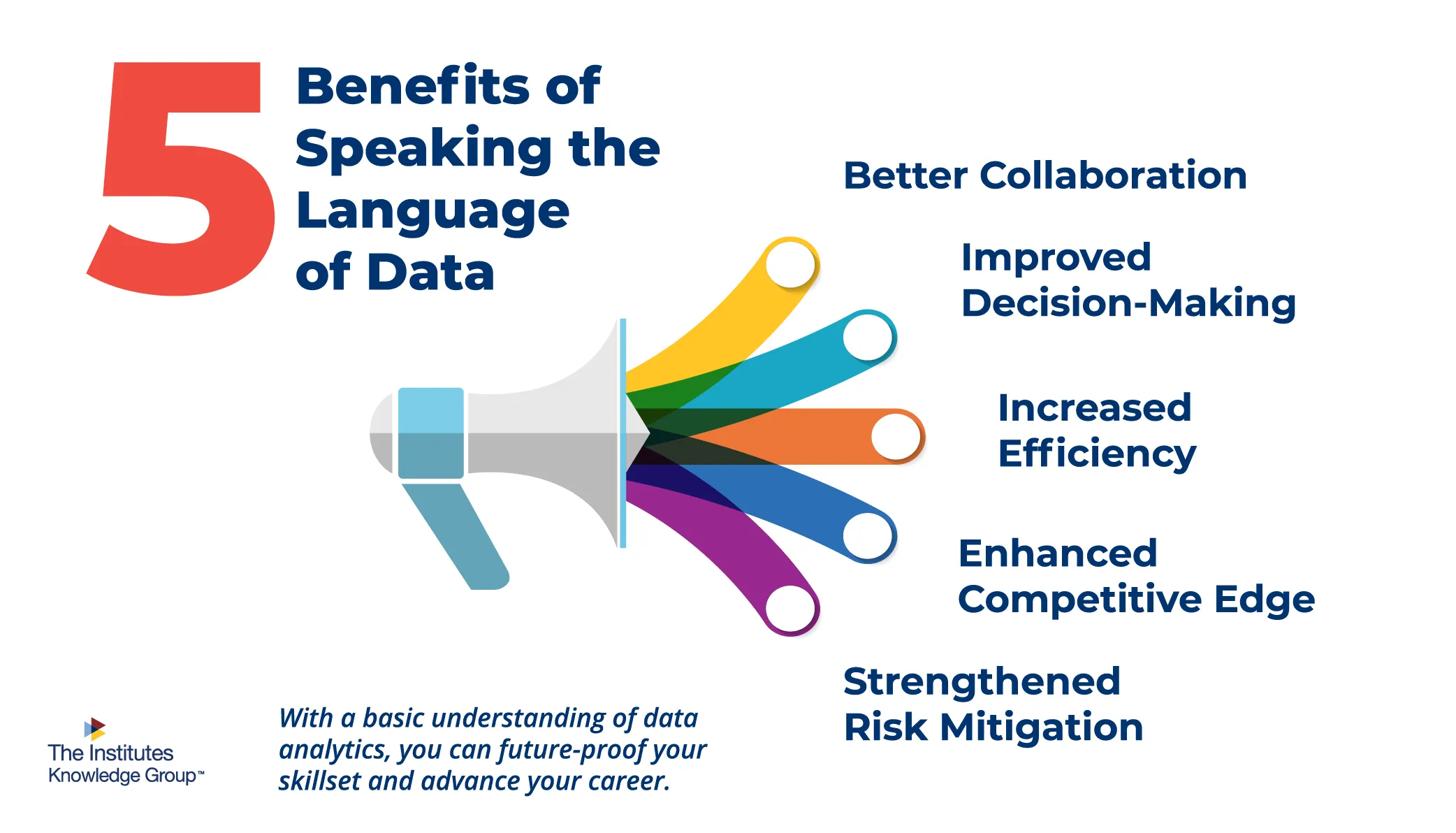

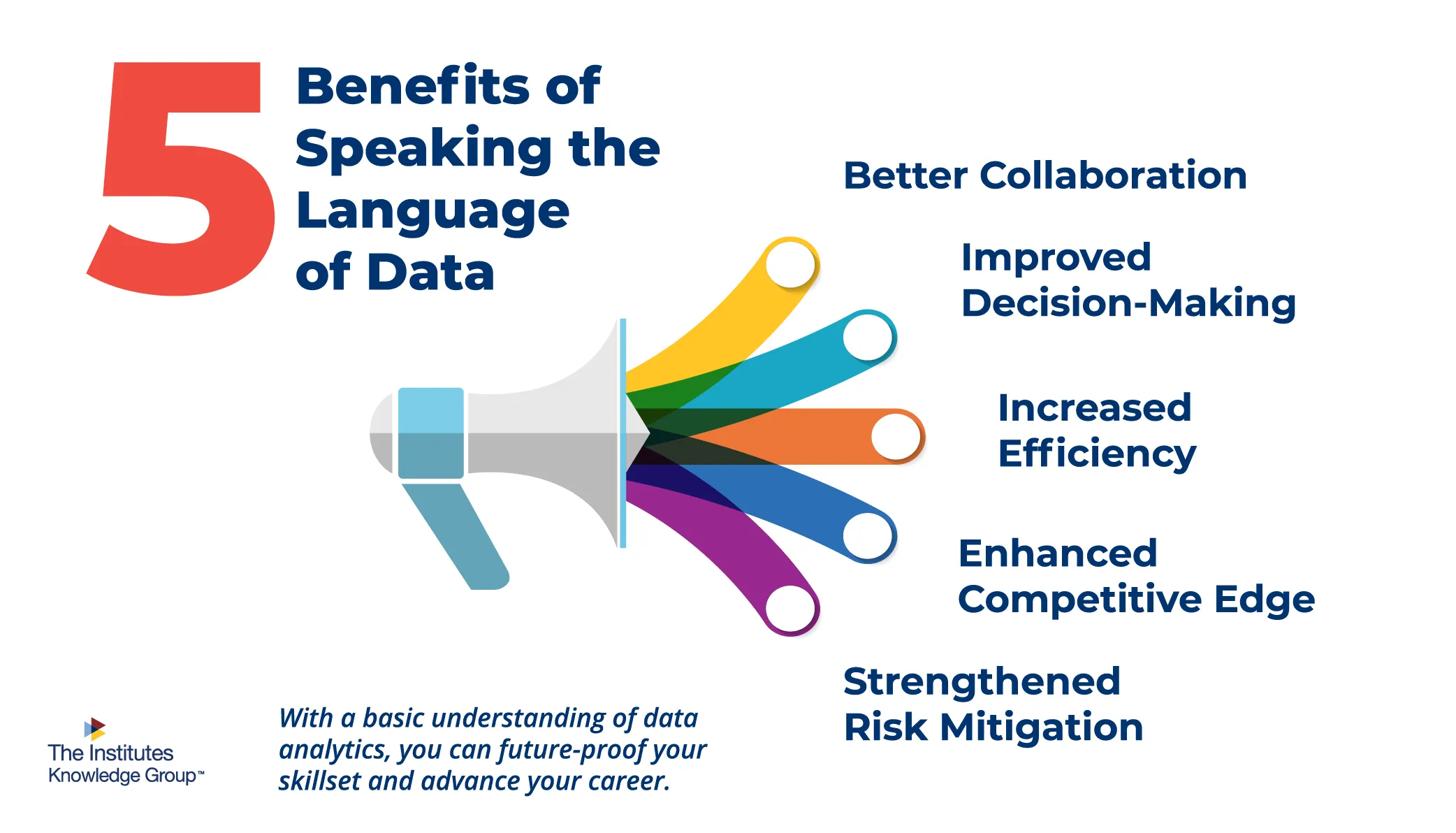

5 Benefits You’ll Gain from Speaking the Language of Data

In today's data-driven world, data literacy isn't just a technical skill—it's a vital component of professional growth and organizational success. And spending time developing that skill may benefit you in more ways than you realize.

1. Better Collaboration

Understanding basic data science in insurance concepts allows you to have more effective communication and collaboration across teams. Whether you're working with underwriters, actuaries, or data scientists, being able to have efficient conversations using the correct terminology helps ensure everyone is aligned.

2. Improved Decision-Making

Data literacy enables you to make evidence-based decisions. By knowing how to access and analyze relevant data, you can better identify trends, uncover insights, and predict future outcomes with greater accuracy.

3. Increased Efficiency

Proficiency in data analysis allows you to automate routine tasks and optimize workflows. For example, using data algorithms to automate claims processing can speed up the resolution time and improve customer satisfaction.

4. Enhanced Competitive Edge

Both individuals and organizations gain a significant advantage by leveraging data insights. For individuals, data literacy enhances career prospects and professional growth. For organizations, it means being able to offer better products, services, and customer experiences.

5. Strengthened Risk Mitigation

Data analysis provides a clearer understanding of risks and potential vulnerabilities. By identifying patterns and predicting possible issues, you can help minimize losses, boost profitability, and ensure a more stable and secure operational environment.

Understanding the Fundamentals of Data Science in Insurance

While data analytics may seem daunting at first, it's more accessible than you might think! Courses such as AIDA 402: Developing and Implementing Data-Driven Strategies can help you feel confident with the fundamentals of data science including:

High-Quality Data Collection

Collecting high-quality data is a key first step to making better decisions. Insurers gather and analyze data to better understand customer profiles and risk landscapes. Good data collection practices streamline operations and uncover new opportunities for innovation.

Proper Data Management

Managing data well ensures its reliability and trustworthiness. For example, categorizing telematics data by factors like speed and braking patterns helps insurers spot behaviors that might affect claims. This structured approach enhances data accuracy and makes it easier to extract actionable insights.

Efficient Data Communication

Efficient data communication bridges the gap between data science and traditional insurance roles. By bringing together data scientists, actuaries, underwriters, claims specialists, and more, insurers can make insightful decisions and respond faster to market trends.

Understanding these concepts and more will allow you to build a culture of data literacy at your organization, ethically manage data, and establish yourself as a trusted RMI leader.

Develop In-Demand Data Analytics Skills and Grow Your Career

Adopting a data-driven culture is a team effort. Everyone across the organization has a responsibility to better understand and communicate about data. After all, big data and technology are central to the future of the risk management and insurance business.

That’s where a commitment to your learning and professional development comes in. The Institutes Designations’ all-new Associate in Insurance Data Analytics® (AIDA™) is designed to help you understand data science principles so you can speak the language of data, future-proof your skillset, and grow your career.

About the Author

Eric Czerwin is Director of Sales for The Institutes Knowledge Group. With a background in risk management and underwriting, he bridges strategic insight with practical execution while fostering long-term relationships. His focus is on empowering carrier workforces with enhanced skills and insurance field knowledge through organizational learning and development initiatives.